Our Social Asset Management Technology

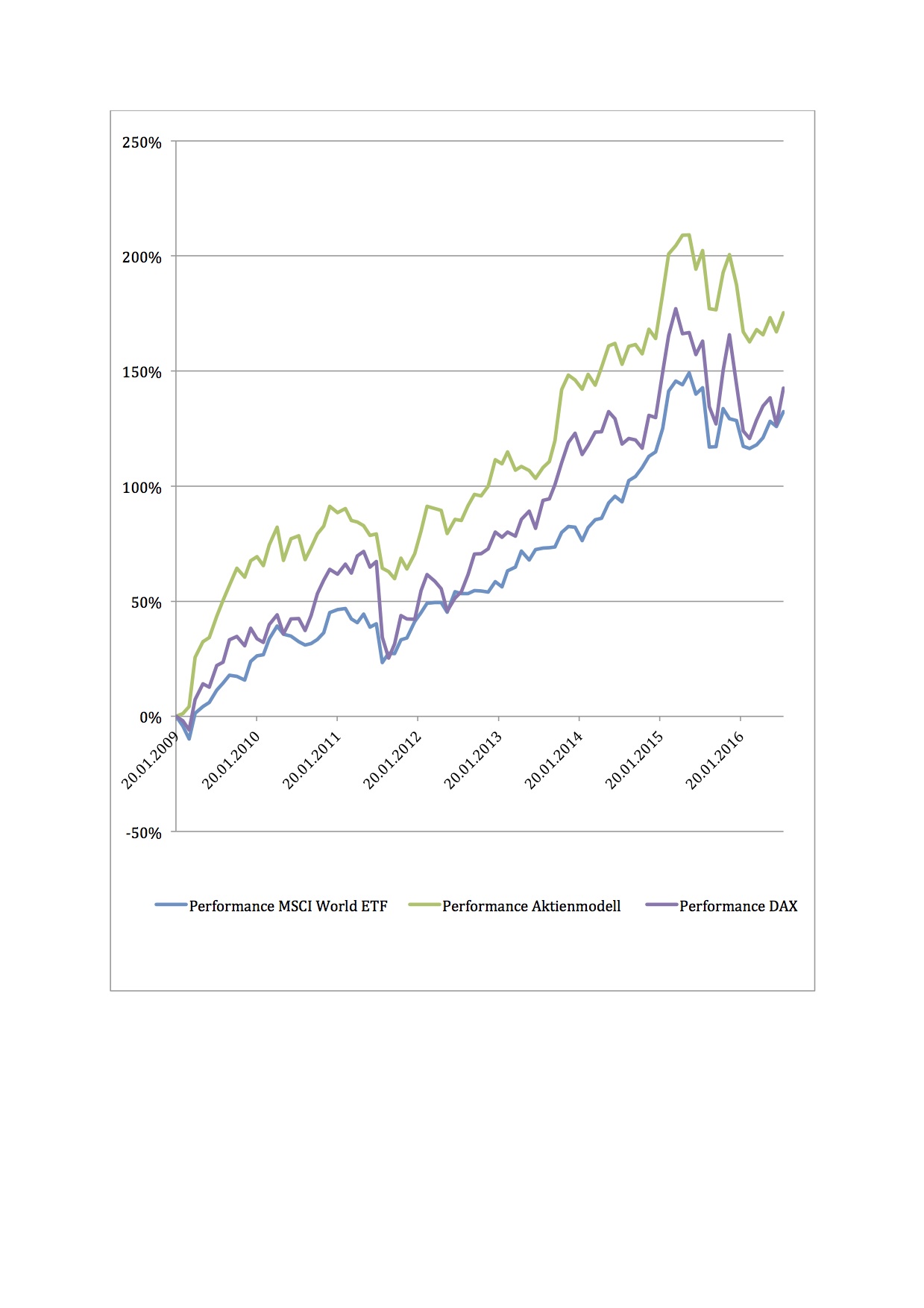

Investment Products are managed with the aggregated Recommendations of the Intelligent Recommendations System. The Trading System on the base of Stocks (see "Performance Aktienmodell" in the Chart) from January 2009 until August 2016 has an Performance of +175%. See the Chart:

That is an Outperformance of +33.2% in opposite to the DAX and +42.9% in opposite to MSCI World at lower Volatility compared to both indices.

We want to give most of the Outperformance of the Reference Indices to the investors, so we emitted low cost index certificates, that are generated by the 5 collective model stock portfolios for each risk class. Additionally we offer 3 Stock Products.

You get to the Infos and Links of our Index Certificates on our Product Page..

Reports about Performances of our Products we publish on our Facebook Page: https://www.facebook.com/IntelligentRecommendations

Investment Concept

A Picture about our System shows the Superorganism that is created when independant diversified recommendations are aggregated with our statistical methods.

Incorrect decisions are minimized, success quotes are heigthended.

Take part in our system on the base of collective Intelligence and benefit from the scientific optimization of your personal investment.

Choose the Index Certifitcate that you like to participate in the success of our technology.

All our Index Certificates you find on our Product Page

Because Funds mostly have high Product costs with a TER of 2-4% p.a. in average, which minimize the Performance, in our opinion those products are not competitve anymore. That is why we decided to make a change of strategyfrom Fund Managing to the Management of low cost Index Certificates, for that the Outperformance of our system compared to Reference indices is the direct profit for the investor.

The Fund ist not tradeable anymore.

The algorithms of the Intelligent Recommendations Systems are based on the scientific principles of collective intelligence. This allows you to invest in stocks as soon as broad interest develops, that is to say generally speaking before an upswing in share prices, as well as to divest of stock in case of flagging interest, i.e. before negative opinions translate into falling prices.